r&d tax credit calculation uk

Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. Maximise your R.

Rdec Find Out How You Can Claim

First however the fix-based percentage must be obtained by.

. Im new to Claming. Most companies in the UK that claim RD tax relief fit into the SME category. Use our free tool to quickly estimate if youre eligible to claim RD tax relief.

Use the RD tax credit. For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss-making SME can receive will be capped at 20000 plus three times the amount paid in respect. But its straightforward once you understand the basics.

RD Tax Credits is an incentive for UK business that have invested in innovation and completed research and development. Calculating your RD tax credit return may seem like a daunting and confusing task. Try Xero Free Today.

Be Confident In The RD Tax Credit Partner You Trust To Advise Your Clients. 100000 x 230 230000. Call 01332 819 740.

Ad Xero software lets you connect with your bank collaborate with your accountant staff. Just follow the simple steps below. RD Tax Credits Whether youre new to RD.

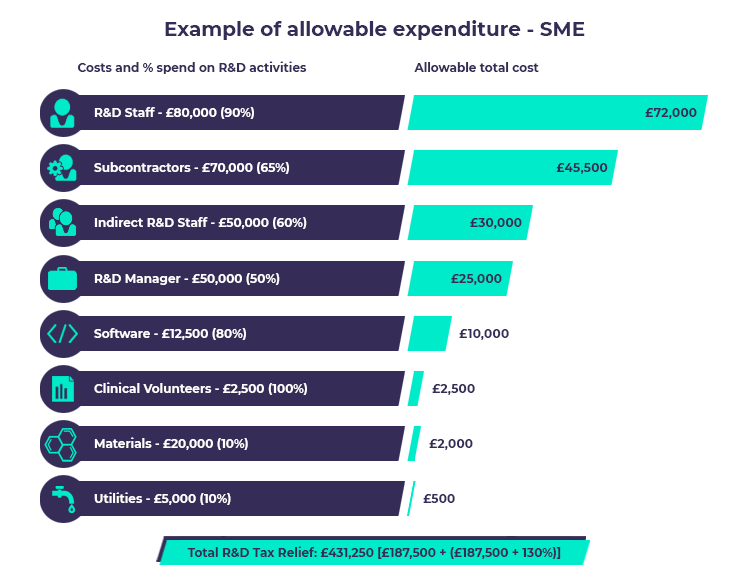

RD Tax Credits are one of the UK governments incentives to encourage UK companies to innovate and provide companies with access to cash. RD Tax Credit Calculations Explained. How to Calculate RD Tax Credit for SMEs.

Ad Select The Best Tax Credit Partner With Our 8 Point Checklist. Manufacturing Architecture Engineering Software Tech More. Our RD tax credit calculator gives you an instant estimate of your potential.

Join 3M subscribers keep on top of cash flow get paid faster. RD Tax Credit Calculator. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount.

Ad Aprio performs hundreds of RD Tax Credit studies each year. Try Xero Free Today. RD Tax Credits Explained.

The rate at which businesses calculate their RD tax credit depends on. Ad Xero software lets you connect with your bank collaborate with your accountant staff. Our free RD Tax Credit Calculator instantly crunches your numbers and shows how much in RD Tax Credits your business could claim from HMRC.

Select either an SME or Large. The UK RD tax credit scheme offers UK companies a great opportunity to claim tax relief based on RD costs. It was increased to.

R. Say our example SME made a loss of 300000 for the year with the same 100000 RD QE and chose to surrender losses and claim relief. Call 01332 819 740.

RD Tax Credit Calculation Examples - The calculation of your RD tax relief benefit depends if your company is a Profitable SME Loss making SME or Large Regime. To be eligible you. If you dont have all.

Join 3M subscribers keep on top of cash flow get paid faster. The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017.

What Increased Audit Scrutiny Means For Your Uk R D Tax Claims

We Look At The Definition Of R D Tax Credit For Uk Businesses

R D Tax Credits 360 Research And Development

R D Advance Funding Early Access To Your R D Tax Credit Mpa

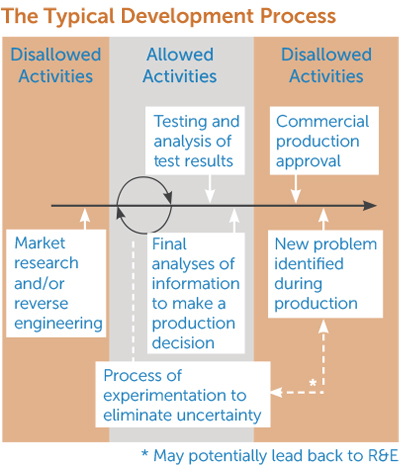

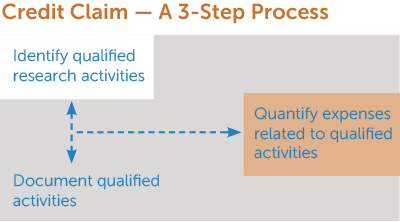

Tax Credit For Increasing Research Activities Tax Services Cla Cliftonlarsonallen

R D Tax Calculator R D Tax Credit Abgi Uk

Tax Credit For Increasing Research Activities Tax Services Cla Cliftonlarsonallen

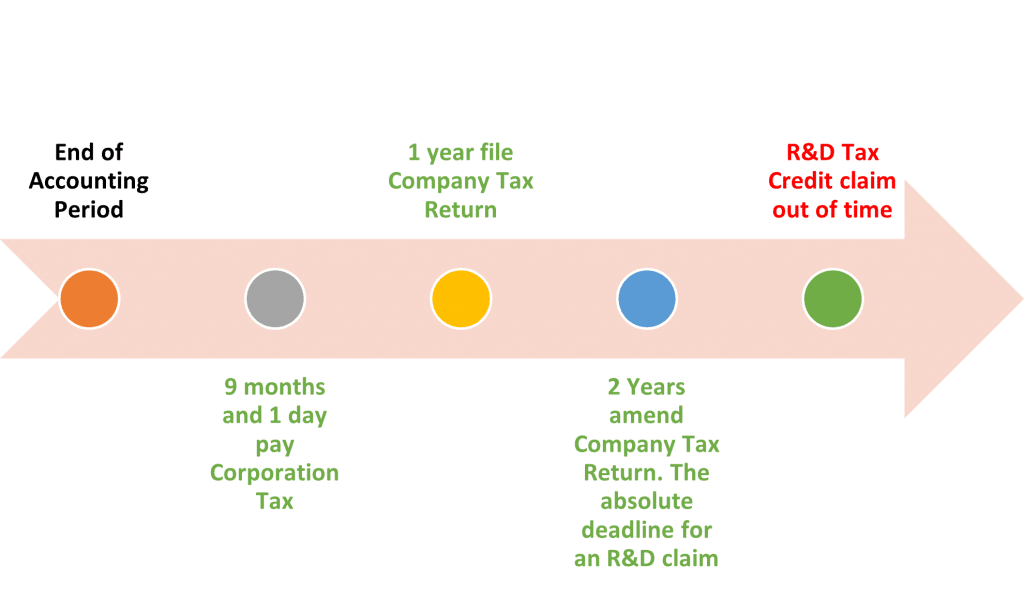

Key Questions About Deadlines And R D Tax Credit Claims Randd Tax

Research And Development R D Tax Relief M J Bushell

R D Tax Credits Explained What Are They Who Is Eligible

How To Enter Research And Development Claims

R D Tax Credits Calculation Example For Smes Veritas Noble

Blog R D Archives Source Advisors

R D Tax Credit Calculation Examples Mpa

R D Tax Credits Uk What Is It How To Claim Capalona

Rdec 7 Steps R D Tax Solutions

Research Development Tax Credits Guide Ebs European Business Solutions